How to split your credit card bill? It takes just a few minutes through SC Mobile App.

*Only applicable to Standard Chartered / MANHATTAN Credit Cards cardholders.

Enjoy up to HKD25,000 miles (Applicable for Standard Chartered Cathay Mastercard Cardholders only) / 2,500 CashBack (Applicable for other eligible cards cardholder)#

Successfully applied for a Credit Card Statement Instalment Program via online with drawdown amount of at least HKD10,000 without any manned intervention on or before 31 July 2025.

Lucky Draw Chances:

New Cardholders*: 10 Lucky Draw chances for every drawdown amount of HKD10,000

Non-New Cardholders : 5 Lucky Draw chance for every drawdown amount of HKD10,000

Promotion Period:

6 May 2025 to 31 July 2025

For more details, please click here

Summer Rewards: As low as HKD50 one off handling fee (Applicable for selected customer only)

For more details, please click here

# Up to 25,000 Asia Miles (“Miles”) (Applicable for Standard Chartered Cathay Mastercard Cardholder) or Up to HKD2,500 CashBack (Applicable for Other Eligible Cards Cardholder)

|

Drawdown amount

|

New Cardholders*

|

Non-New

Cardholders |

New Cardholders* consecutive 4 months to success apply credit card statement instalment:

|

Non-New Cardholders consecutive 4 months to success apply credit card statement instalment:

|

|

|---|---|---|---|---|---|

| Rewards | Extra Rewards | ||||

| Standard

Chartered Cathay Mastercard

|

HKD5,000 – 14,999 | 500 Miles | 500 Miles | Extra 5,000 Miles | – |

| HKD15,000 – 29,999 | 2,000 Miles | ||||

| HKD30,000 or above | 5,000 Miles | Extra 5,000 Miles | |||

| Other Eligible

Cards

|

HKD5,000 – 14,999 | HKD50 CashBack | HKD50 CashBack | Extra HKD500CashBack | – |

| HKD15,000 – 29,999 | HKD200 CashBack | ||||

| HKD30,000 or above | HKD500 CashBack | Extra HKD500CashBack | |||

| Applicable to Tenor of 12 months or above. | |||||

Up to 60 months

Flexible Instalments

As low as 0.19%

Low and personalized Handling Fee²

Minimum spending HKD 500

Settle whole or partial retail purchase amounts by instalment¹

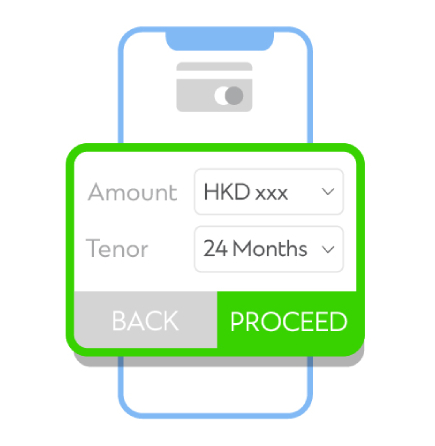

Login to SC Mobile and click “Split Your Bills” on the selected bill or transactions

Select the transactions you wish to pay by instalment and input details e.g. amount, tenor etc. to proceed

Review details and submit with Instant approval

|

Transaction Amount

|

Monthly Handling Fee (%)3

|

Daily Handling Fee4

|

|---|---|---|

| HKD500 | 0.19% | HKD0.032 |

| HKD25,000 | 0.19% | HKD1.58 |

Remarks:

*New Client refer to cardholders of Eligible Cards who do not currently have or have not successfully applied for a Credit Card Statement Instalment Plan with Standard Chartered Bank (Hong Kong) Limited in the past 12 months prior to the Promotion Period.

1. Application requirements:

2. The availability of exclusive personalized Monthly Handling Fee of 0.19% is individualized and subject to account status checking. Different Statement Instalment Transactions could not be combined for the purpose of calculating the handling fee. Monthly Handling Fee ranges from 0.19% to 1.35%.

3. Annualised Percentage Rate (APR) of 0.19% Monthly Handling Fee is:

|

Transaction Amount: $500

|

Non Statement Instalment:

Apply the instalment loan before the issuance of credit card statement |

Statement Instalment:

Apply the instalment loan after the issuance of credit card statement |

|---|---|---|

| Tenor | APR | |

| 6 month | 3.97% | 4.20% |

| 12 month | 4.26% | 4.40% |

| 18 month | 4.36% | 4.45% |

| 24 month | 4.40% | 4.48% |

|

Transaction Amount: $25,000

|

Non Statement Instalment:

Apply the instalment loan before the issuance of credit card statement |

Statement Instalment:

Apply the instalment loan after the issuance of credit card statement |

|---|---|---|

| Tenor | APR | |

| 6 month | 3.97% | 4.20% |

| 12 month | 4.26% | 4.40% |

| 18 month | 4.36% | 4.45% |

| 24 month | 4.40% | 4.48% |

For Statement Instalment, this APR is calculated in the assumption that the instalment application date is 25 days prior to the statement repayment date, and the first two months handling fee will be posted in the next monthly statement.

An APR is a reference rate which includes the basic interest rates and other applicable fees and charges of a product expressed as an annualized rate. In general, the Instalment Amount is a fixed amount to be charged to the Card Account on a monthly basis, while the APR for the first instalment may be impacted by the loan disbursement date.

Please note there is no difference in the total handling fee (or total absolute amount of interest) charged and repayment amount between Non Statement Instalment and Statement Instalment.

4. Daily handling fee is calculated based on 30 days per month.

If you choose to repay the total Statement Instalment Transaction Amount outstanding in full for each Statement Instalment Transaction prior to the end of the Instalment Period, or if the Card Account on which the Statement Instalment Transaction Amount appears is cancelled due to any reason, the total Statement Instalment Transaction(s) Amount outstanding at the relevant time and the Monthly Handling Fees (if applicable) for the remaining Instalment Period will be immediately due and payable. Also, administration fee for early repayment of HKD150 for each Statement Instalment Transaction will be charged directly to your Card Account. For example, assuming one single Statement Instalment Transaction Amount is HKD15,000 with a Monthly Handling Fee of 0.25% for a 12-month Instalment Period – if you repay the total Statement Instalment Transaction Amount after the 6th month, you shall be liable to pay the total Statement Instalment Transaction Amount outstanding and the Monthly Handling Fees for the remaining period of 6 months, being HKD15,000 / 12 x (12-6) + HKD15,000 x 0.25% x (12-6) = HKD7,725, plus an administration fee of HKD150. The above example is for indication purpose only.

Application hours for registration hotline: 9a.m. to 10p.m. daily (Monday – Sunday).

SC MOBILE APP

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.. Android, Google Play, and the Google Play logo are trademarks of Google Inc.